Consult with your tax and/or legal advisors to determine if an exchange is in your best interest and is in line with your investment goals.

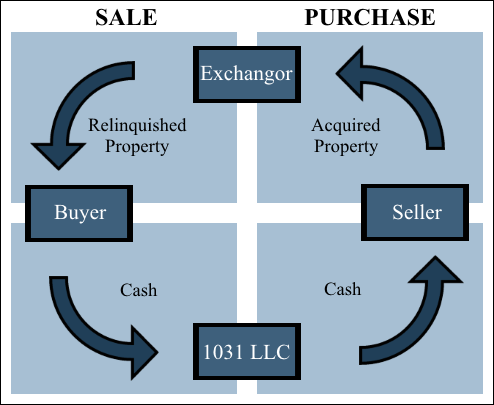

Enter into a Purchase and Sale agreement for the sale of Relinquished Property. Make sure to include language stating your intent to perform a tax deferred exchange.

Open escrow and contact TEN THIRTY ONE, LLC.

Close Relinquished Property: Exchange and Escrow documents are executed. Title is conveyed to the buyer. Exchange funds are transferred from escrow to TEN THIRTY ONE, LLC.

Identify Replacement Property within 45 calendar days from the date of closing on Relinquished Property.

Enter into Purchase and Sale Agreement for the purchase of Replacement Property.

Open escrow and contact TEN THIRTY ONE, LLC.

Close Replacement Property: Exchange and Escrow documents are executed. Exchange funds are transferred to escrow from TEN THIRTY ONE, LLC. Title is conveyed to the Exchangor. (Replacement Property must close on or before the 180th calendar day following the closing of the Relinquished Property or the date on which your tax return must be filed, whichever occurs first.)