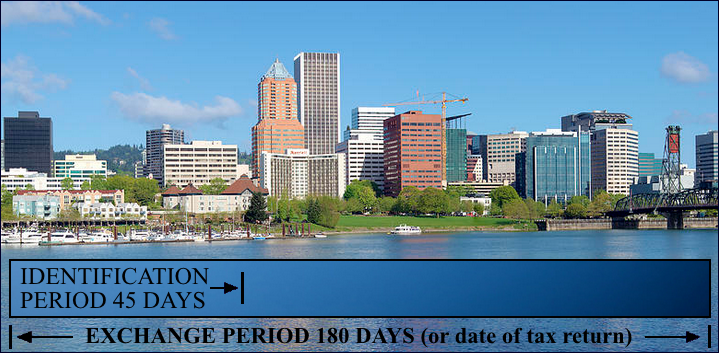

45 DAY RULE: The potential Replacement Property must be identified within the first 45 days after the closing of the Relinquished Property. The Replacement Property must be identified in writing and signed by the Exchangor. This must be delivered, mailed, faxed or otherwise received by TEN THIRTY ONE, LLC on or before the 45th day deadline.

180 DAY RULE: The Replacement Property must be purchased on or before the 180th day after closing of the Relinquished Property, or the date the Exchangor files their tax return, whichever occurs first.

THREE PROPERTY RULE: The Exchangor may identify three (3) properties of any value; or

200% RULE: The Exchangor may identify more than three properties if the total fair market value of what is identified does not exceed 200% of the sale price of the Relinquished Property. The value of each property must be stated on the identification form; or

95% RULE: If the Exchangor violates the 200% rule, it is still possible to have a successful exchange, if the Exchangor acquires 95% of the fair market value of what was identified.